Why You Should Be Careful With Your Realtor’s “Preferred Lender” (The Truth Nobody Talks About)

Why You Should Be Careful With Your Realtor’s “Preferred Lender” (What Buyers Don’t Know)

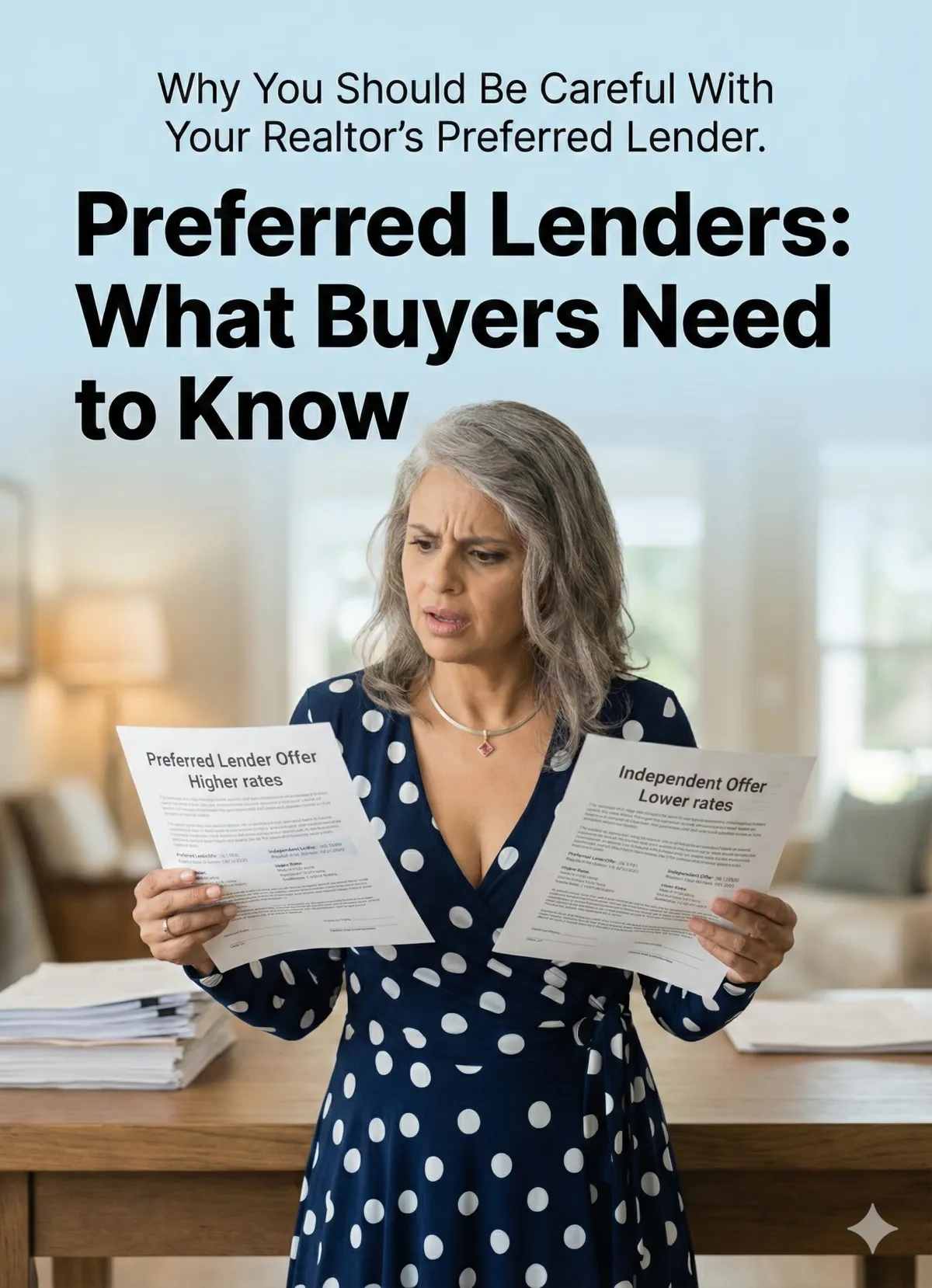

Most buyers think that when a realtor recommends a lender, it’s because that lender is the best option.

Sometimes that’s true.

But a lot of the time, the referral has nothing to do with great service — and everything to do with business arrangements happening behind the scenes.

Let’s break this down simply so you know what’s really going on and how to protect yourself.

What’s Actually Happening Behind the Scenes

Many brokerages now have:

“in-house” lenders

joint-venture mortgage companies

lenders who pay for office space

lenders who share profits with the real estate company

Sounds convenient, right?

But here’s the truth:

More layers = more people getting paid from your loan.

And when more people get a cut, the cost usually shows up in:

higher rates

higher fees

fewer loan options

pressure to stay in the brokerage’s ecosystem

Most buyers never realize they’re the ones footing the bill.

Where Buyers Get Pressured Without Realizing It

Realtors and builders often make steering sound harmless by saying things like:

“Our lender can close faster.”

“Use our lender to get the credit.”

“The seller prefers you to use our lender.”

“Everything stays in-house and runs smoother.”

These statements aren’t always wrong…

but they’re not always honest either.

Sometimes they’re used to push buyers into a lender who benefits the brokerage — not the borrower.

Common Steering Tactics Happening Right Now

Across FL, GA, and SC, I see these constantly:

1. Builder Credits That Aren’t Really Credits

Builders offer money toward closing costs — but then bump up the interest rate.

Buyers don’t notice until it’s too late.

2. Agents With Referral Quotas

Some brokerages track how many referrals agents send to the in-house lender.

More referrals = better standing in the company.

That’s not about the buyer.

That’s about the brokerage.

3. Fear-Based Language

This is the most harmful one.

Buyers are told their offer might be “weaker” if they don’t use the preferred lender.

That is not true when you’re working with a strong, experienced mortgage team.

⭐ Important: Interconnect Mortgage Has ZERO Paid Relationships With Realtors

No kickbacks.

No referral fees.

No joint ventures.

No financial arrangements of any kind.

When a realtor recommends us, it’s because they trust the work we do — not because we’re paying them.

And that’s exactly how it should be.

5 Questions Every Buyer Should Ask Before Using a Realtor’s Preferred Lender

Screenshot this list or save it in your Notes.

1. Do you or your brokerage get paid when I use this lender?

You deserve a clear yes or no.

2. Are you required or encouraged to send business to this lender?

Pressure = red flag.

3. Can I see written comparisons from at least two other lenders?

If they resist… you know why.

4. Will choosing my own lender hurt my offer?

A great agent will always say no.

5. Who actually works on my loan?

Some preferred lenders act as figureheads and pass your file to someone else.

How to Check If a Lender Is Actually Good

Do a quick personal audit:

Look up the LO’s license on NMLS Consumer Access

Check third-party reviews (not just reviews on their website)

Ask how many loan programs they offer

Ask who handles communication and updates

Ask for a written breakdown of rates, fees, and loan options

Check out our 3rd party reviews at: https://g.page/r/CerIw6RMVnTUEAE/review

If a lender only has one or two loan types… they’re selling what they have, not what’s best for you.

What a Truly Buyer-Focused Lender Looks Like

A great lender should:

explain every number clearly

compare multiple loan options

return calls/texts quickly

communicate every step of the way

give transparent pricing

help you understand the market

be independent from a brokerage’s financial arrangements

Buying a home is stressful enough. You shouldn’t feel pushed, rushed, or cornered.

How to Protect Yourself Right Now

✓ Step 1: Get at least two quotes.

One should always be from a lender not tied to your agent.

✓ Step 2: Compare the numbers.

You’ll quickly see if the preferred lender padded the rate or fees.

✓ Step 3: Choose the lender who educates and supports you — not the one who pressures you.

This is your loan. Your money. Your home.

You deserve the best deal and the best experience.

FAQ: Preferred Lenders & Steering

❓ Do I have to use my realtor’s preferred lender?

No — ever. You’re free to choose any lender you want.

❓ Will not using the preferred lender hurt my offer?

No. What matters is a solid, complete preapproval and strong communication.

❓ Why do agents recommend certain lenders?

Sometimes convenience. Sometimes strong relationships.

Sometimes the brokerage earns money on the referral.

❓ Are builder credits real?

Yes — but the cost often gets added back into the interest rate. Compare the numbers.

❓ Does Interconnect Mortgage pay realtors for referrals?

Absolutely not. We never have paid referral relationships, and we never will.

❓ How do I know if I’m getting a good deal?

Compare at least two loan estimates side-by-side.

Independent lenders almost always offer more programs and better pricing.

Want to Make Sure You’re Getting a Fair Deal?

If you’d like, I can run your numbers and show you how your offer compares — side-by-side, with full transparency.

Book a free 15-minute call:

👉 https://interconnectmortgage.com/calendar

Disclaimer

This content is for educational purposes only and not a commitment to lend.

Interconnect Mortgage — NMLS 1720882.

Licensed in Florida, Georgia, and South Carolina.

Check licensing at NMLS Consumer Access: https://www.nmlsconsumeraccess.org